The time before the Brazil harvest is typically a period of maximum tightness. We are globally drawing down inventories the world over in preparation for the coming year’s fresh supply. The flip side of that is that once the Brazil crop arrives, that is the period when supply begins to build for the year and from July to January, the world will be producing coffee.

This year, we hold a generally bearish outlook for the coffee market over the next 6 months as the world starts to unwind the worries of the last 2 years of coffee deficits.

As fundamental analysts, we base our market view on expectations for supply and demand. We show the world in a modest surplus for 23/24 after back-to-back deficits and our price models show a decline in fair value from around 185c currently, to 160c in 6 months to 145c in 12 months.

Robusta is a little more elusive, but we think it is possible that we get a bit more of a rally before declining back to $2200 and then it will likely feel some downward pressure from Arabica.

[Get ahead in the coffee market with a free trial of our Premium Market Reports. Sign up now!]

Arabica Coffee Outlook

Our estimations of fair value are based price models that use stocks-to-use as an input. In other words, the availability of coffee is divided by the consumption of coffee. When stocks are very low, the model shows prices as high and when stocks are high, prices tend to decline.

Looking at destination stocks, we can see that (seasonally speaking) it is almost certain that we will see stock build over the next several months, especially if you have the global market in surplus as I do.

There are inverted calendar spreads in Arabica, a major bullish factor, but we believe that this is on the way out.

We believe certified inventory is a major driver of the inversion, and with differentials declining and fresh coffees available, that certified stocks will recover.

Not only are fresh crop coffees available at cheaper levels than we have seen in months, but we have also heard reports that there are unsold coffees in Honduras that could be sold to the board.

All of this is likely to mitigate the cert stock draw which can reverse the inversion. If the inversion is indeed reversed back to carry, the spec long will lose one of its biggest incentives to stay long.

[Take the guesswork out of your coffee business decisions. Sign up for a free trial of our Premium Market Reports today! ]

Robusta Coffee Outlook

Robusta we think may have a bit more rallying to do as the world adjusts to increased robusta demand and Arabica prices remain elevated. The technical strength also remains strong here and the spec long has a bit more room to grow.

However, Robusta strength is ultimately limited by the max long position of speculators. The specs can continue to drive prices higher but they can only drive the market so far. For additional rallying we will need to see roasters decide to buy from speculators, but at that point the robusta rally will be over, especially if Arabica prices decline.

There is some indication that the Robusta market drove the rally in Arabica these last couple of months, however this is the tail wagging the dog and will not last. Ultimately, Arabica is the default bean of choice for most roasters, and roasters will rotate back to Arabica given the choice. The decline of Arabica prices and the rise of Robusta prices will make that choice a lot easier.

[Get a taste of our expertise in the coffee market (and maybe a dad joke or two😉) with a free trial of our Premium Market Reports. Sign up here!]

Hedge Funds

Hedge funds can get a lot of hate from farmers and physcial traders, but farmers at least should be thanking the funds at this point, because the speculator has been one of the primary drivers for the current rally. Hedge funds are VERY long in both markets as a percentage of Open Interest..nearly 20% in Arabica.

This has created incredible demand for futures which corresponded to the rally from 160 up tot 200c. However, this is double edged sword and will ultimately be a source of selling. Over the next 6-12 months the speculator will be looking to the 24/25 crop in Brazil (estimated to be a record by some at this early stage) and if the inversion has disappeared there is a good chance that the spec will not only liquidate their longs, but potentially go short.

Mitigating factors

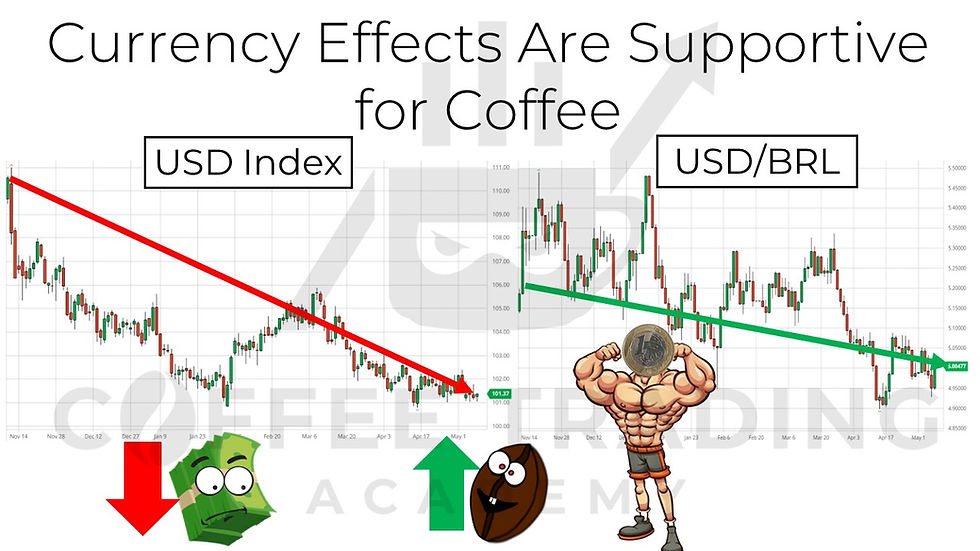

The primary mitigating factors on bearishness here are two: the impact of currencies on coffee prices and the technical strength in the market.

The USD is bearish based on the end of rate hikes and the expectation that the we may start to engage in a rate loosening cycle. Additionally, the BRL is benefiting from the weak USD and the declining inflation. Both of these factors will serve to provide upward pressure on the coffee market.

Using correlations with coffee prices we can expect perhaps 5 –25c of bullish impact on coffee prices from currencies alone. However, this would be more than offset by a spec position that goes from long, to even modestly short.

The other currently mitigating factor is technical strength.

We are fundamental analysts so we place less importance on technical indicators, but we do believe they at least represent the psychology of the market to some degree. We show the technical indicators as mixed in Arabica, and fairly bullish in Robusta.

Arabica has a long-term bearish trend line that is intact, but we also have a 20/200 SMA bullish cross. These are essentially conflicting bullish and bearish long term indications.

Robusta by contrast looks to be pretty solidly bullish at the moment with a consolidation pattern suggesting new highs are possible.

[Like what you are reading? You will love our Premium Coffee Market Reports. We provide the latest insights and trends to keep you informed. Join for your free trial today!]

However, the biggest mitigating factor, one we haven’t even mentioned yet, would be the weather.

Any weather any weather shocks would be a major game changer. Just as the generals are always fighting the last war, the market is always focused on the last crisis. In coffee, that would be frost.

Hard to say this early in the season whether we would have frost or not, but I would say two things. There will almost certainly be a frost scare in July that will rally the market. If a frost of any size does materialize, the market will go bonkers. Also, frost does seem to be slightly less likely due to the presence of moisture in the long term forecast.

The other big weather problem could be drought or problems with rainfall during the flowering in Brazil. We will be watching this closely.

Conclusion

My outlook is based on my understanding and estimation of the fundamentals. If my estimations of supply and demand are inaccurate, then the conclusions would be inaccurate.

Always important to keep your own account of these, even if its only the major origins. This will help you to maintain your own view on market expectations.

The market is forward looking, another factor that I haven’t spoken much about is the 24/25 crop.

Current expectations for the 24/25 crop are excellent based on new growth. However, we will be watching the flowering and the setting in the coming months to gain insight into how the 24/25 crop will look. As we approach this crop the market will be pricing in the expectations for this crop. However, at that point we will be pricing in the next forward crop.

[Make smarter moves in the coffee market with a free trial of our Premium Market and Weather Reports. Sign up now!]

コメント