Tenderable Parity Analysis: Exploring Economic Viability of Semi-Washed Brazilian Coffee Blends

- Ryan Delany

- Aug 29, 2023

- 6 min read

By Ryan Delany, Chief Analyst at Coffee Trading Academy 8/25/2023

I. Introduction

Coffee futures market is inexorably linked to the certified inventory. This keeps the price of the futures “real” with physical coffee. As such we can look at the supply and demand of certified inventory to determine expectations for futures market prices and calendar spreads. However, the supply of certified inventory is driven by considerations beyond merely how much coffee is produced or consumed in the world, instead we need to understand "tenderable parity", the breakeven price at which it make economic sense to certify coffee.

In todays market environment of very low certified inventory, it is more important than ever to understand if and when coffee will become certified, so that we can predict the flow of new certified stocks into inventory, and ultimately the direction of prices.

We believe that the most likely source of new certified coffees will come from Brazil, and so in this paper we evaluate several scenarios to show how this might happen. First we briefly describe the mechanics of tenderable parity, and then we evaluate the current state of tenderable parity for washed Brazil’s. Finally, we examine the economic viability of the controversial practice of tendering blends of natural and semi washed coffees.

By conducting this analysis, we aim to show what the incentive is for exporters to try and certify blends, and at what price levels we may see this type of behavior occur.

[Gain a competitive edge in the coffee market with our Coffee Trader's Course. Sign up now and learn the strategies and techniques employed by top traders.]

II. Understanding Tenderable Parity and its Role

Tenderable parity, is the benchmark calculation where one can sell coffee on the exchange and “breakeven”. This benchmark is calculated by adding the transportation and exchange fees to the purchase price differential of coffee, if this total price is equal to 0 then the coffee is said to be at tenderable parity. This function of selling coffee on the exchange is the bridge between the price of physical coffee and the price of coffee futures.

Additionally, since coffee must be certified before it can be sold on the exchange, understanding tenderable parity provides us with insight into the creation of new certified inventory. As coffee certified stocks are at extremely low levels, this creation of new certified stock is the primary concern of this paper.

III. Semi-Washed Brazilian Coffee: Economic Considerations

Brazil has been a controversial tenderable quality since the Intercontinental Exchange (ICE) first added them to the list of permissible coffee origins back in 2013 (grading began in 2012). This was controversial because the “C” contract (originally stood for “centrals” as in Central American), was supposed to be washed arabica contract. The Brazilian coffees are “semi-washed” and so it was thought that this would dilute the value of the contract.

This fear has largely proven correct, but at the same time, Brazil is the primary producer of Arabica by at least a factor of 4 and so it also doesn’t make sense to exclude them from the contract. To account for the potential difference in quality, the exchange added its steepest quality penalty, -4c /lb to Brazilian coffees. However, even with this penalty Brazilian coffee soon came to dominate the exchange.

After the massive Brazilian 2020/21 crop, the exchange saw an incredible influx in Brazilian coffees. Brazilian coffees increased from just 650 bags in August 2020, to 1.1 million bags in August 2021, effectively doubling the total certified inventory.

Since that time, Brazil has come to be recognized as the primary supplier of coffee to the exchange and with the decline of certified stocks over the last 2 years, the market has looked to Brazil to replenish the supply. The question of when that will happen, comes down to tenderable parity.

[Learn the core concepts of trading coffee and managing market risk in the coffee market with our Coffee Trader's Course. Sign up for our Oct class.]

IV. Calculating Tenderable Parity

The math for tenderable parity is straightforward: we add our purchase price differential to freight, logistics and certification costs, and if the sum is 0, then we are at the breakeven price.

First, let’s consider a standard semi-washed NY 2/3, screen 14/16, strictly soft fine cup.

These have had a purchase price of roughly level money (no premium nor discount differential vs exchange price) for a few weeks now. We now must add in all of the costs to this purchase price.

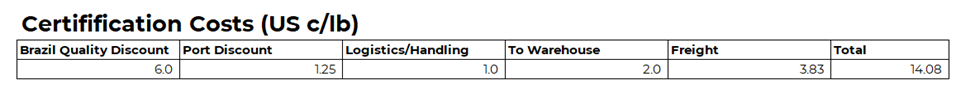

The Brazil quality discount is 6 cents, the cheapest freight to an exchange warehouse is Antwerp, and the port discount is 1.25c. The Freight itself is 3.83 cents, plus another 2 cents to get the coffee to the warehouse. We can finally add in another penny or so for exchange fees and other costs, and the total cost to certify this coffee is 14c. Since we are buying the coffee at 0, this would be a 14c loss and is thus pretty far from tenderable parity.

In fact it would suggest that these coffees would need to be about 14c cheaper just to break even. However, looking back in time at the last few times we received semi-washed Brazils, we can see that this is not necessarily the case.

[Sign up for our Oct Coffee Trader's Course and learn how to manage risk in the global coffee markets, from coffee biology to complex derivatives.]

V. Blend Variations and Economic Viability

As we can see from the above chart, there appears to be more to the calculation than merely the cost of a Semiwashed Brazil of tenderable quality. In fact we can see that Brazilian coffee appears to be tenderable, when the ICO index is roughly at –5c, just 3.5 c away from current levels.

This is where the controversy comes in, in order for this to make sense, there must be some other way of buying cheaper coffee and shipping to the exchange. This is where we explore the idea of blends.

The core idea here is that an exporter could either blend natural coffee with semi-washed coffee, or ship a specially prepared natural coffee and attempt to get it to pass grading as a semi-washed. I have spoken to many experienced exchange graders, and from a grading perspective, it can be very difficult to tell the difference between a semi-washed coffee and a natural coffee.

It is in essence like evidence at a trial. No one factor proves without a doubt that a coffee is semi-washed or natural, but the graders attempt to piece the evidence together to draw a conclusion. How many defective beans are there, how consistent is the roast, what is the flavor profile? Based on the answers to these types of questions, the coffees will either pass or fail grading.

In the table below we conduct a comparative analysis, to determine the profitability of these blend variations and their subsequent tenderable parity. We consider three different options:

Blend 1: Add a Few Naturals In

In this scenario, we assume that the exporter is taking 80% semi-washed coffee and mixing in 20% NY 2/3, SSFC (a high-quality natural coffee).

Blend 2: Add LOTS of Naturals In

In this scenario, we assume that the exporter is taking 50% semi-washed coffee and mixing in 50% NY 2/3, SSFC (a high-quality natural coffee).

Blend 3: Special Prep Naturals

In this scenario, we assume that the exporter is using 100% Dunkin Quality (a high-quality natural coffee) after passing it through some kind of special preparation to improve the pass rate, such as using a color sorter.

[Don't let the coffee market keep you up at night! Join our Oct Coffee Trader's Course and learn the core concepts of coffee anallysis and trading]

However, even if we look back to October 2022, the last time that Brazils were certified in large quantities (differentials were much cheaper and freight was similarly priced), we can see that none of the blends above were at profitable levels. This suggests to me that there may be some other methods at play to cheapen the price of Brazilian coffee. For example, past crop coffees could be used or blended with these to make them even cheaper.

This “unseen blend” will likely be the deciding factor for new certified coffees and we think it will be feasible when the ICO Brazil diffs are at approximately –5c.

VI. Conclusion

Ultimately, our primary conclusion is that the cheapest coffee available to tender is Brazil to Antwerp, however, even if we stretch the limits on what is (un)ethical and/or possible to get passed, we are still far away from tenderable parity and hence unlikely to see any new coffees certified at present.

However, looking at the admittedly broad-strokes heuristic of the ICO Brazil natural prices, we can see that they were last certified in size when the index reached a differential of approximately –5c.

This suggests that there is some unseen quality being used for the tenderable parity calculation.

This is not far away from where we are at present. Moreover, the last time differentials reached this price was in the Sep-October timeframe just before the seasonal hedging pressure from the October crops.

It is not at all certain that the same price drop will happen again this year at the same time, however we believe it likely since we have a larger Brazil crop this year. We believe that the looking at the ICO indicator prices will provide a rough indication of when the hidden tenderable parity targets will be achieved and that the magic number, such as it is, is an ICO Brazil price of -5c.

VII. References

ICO Coffee Prices

ICE Certified Inventory

Anonymously provided freight costings as of 8/25/2023

[Register to our Oct Coffee Trader's Course and upgrade your coffee trading skills with this exciting live and online training]

Comments