Colombia’s role as the largest producer of washed Arabica coffees in the world makes it a leader in physical pricing, and a key origin for determining the global balance sheet of washed Milds.

An in-depth understanding of this crucial origin, and the flow of coffee it produces, requires familiarity with the production geography and the relative harvest cycles on both sides of the equator.

In this article, we are going to cover the key coffee growing regions in Colombia, what the trends in production are, and how they are vulnerable and responding to weather patterns.

Colombia Production and Harvests

Although Colombia is well-known for producing high quality, washed Arabica, it has a diverse array of production regions that have been shifting dramatically over the last several years. Additionally, due to its unique position straddling the equator, it's one of the few origins that has a mid-crop, locally called the “Mitaca.”

As the land changes, so does the climate, harvest time and flavor profiles. All of this, along with the Mitaca, ensures a continual output of crops, providing year-round supply and (usually) consistent physical availability. However, recent years has brought devastating weather effects to this vital origin that has decimated production to levels not seen since the Roya outbreaks of 2008.

[Want help getting coffee market research? Sign up for a FREE trial of our premium Coffee market reports! No catch...but maybe a dad joke or two 😉]

Old vs New Production Regions

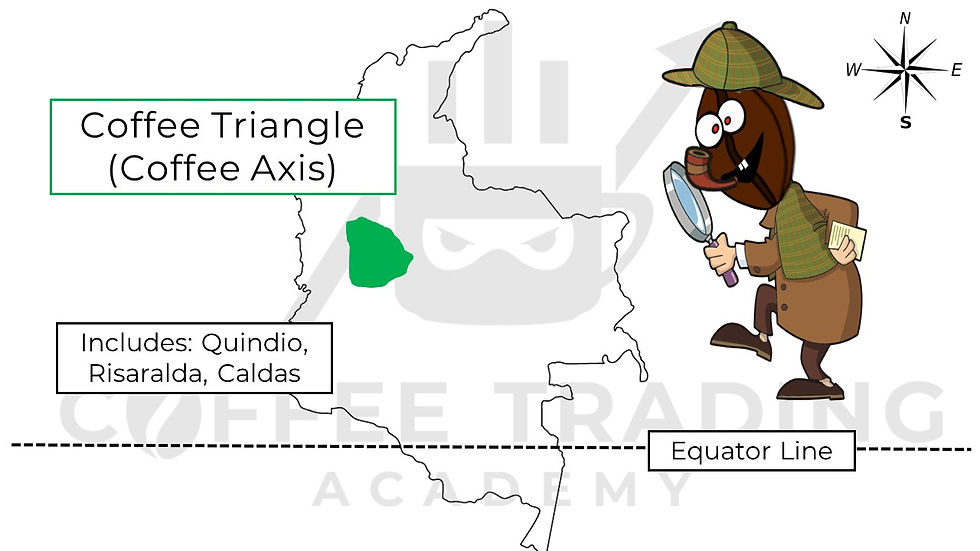

No discussion of the coffee growing regions of Colombia is complete, without mentioning the Coffee Axis, or Coffee Triangle. Based on the Midwest of the country, this is the location of the earliest coffee farms and this region helped to give birth to the coffee industry in Colombia.

However, as time went on production moved outside of this region to include others as well. Nowadays, Colombia’s producing area is formed by 915k hectares concentrated in the west of the country, crossing from south to north through different departments.

Although we commonly refer to specific coffee areas by the names of the departments (Antioquia, Cauca, Tolima, etc), we can divide Colombia’s coffee center into four main zones, based on weather patterns and geographical characteristics in common.

North Zone (Santander, La Guajira and others)

It includes both lower and higher altitude areas that receive ample solar exposure, making for higher temperatures (similarly to Central America) and coffees with less acidity / more body. Just like Central America, the harvest takes place in the Oct-Dec period (main crop).

It accounts for approximately 1.6m bags/year (~14%). However, we estimate that the adverse weather from the past few years has reduced production in ~27%.

Central Zone (Antioquia, North of Tolima and others)

This is the largest region, in both area and production terms, responsible for producing an average of 6.3m bags/year (54% of total). It includes the Antioquia department, which is one of the most important and famous production centers.

Harvest in all departments is collected from Oct to Dec. Since this period was heavily affected by wetness over the past 2 harvests, we estimate that the yearly production of the Central Zone lost a 1.7m bags potential since then.

Eastern Zone (Arauca, Caquetá and others)

This is the smallest of the regions, with only 10.5k hectares of planted area (producing ~200k bags per year). It is also part of the main crop, given its Oct-Dec harvest. We estimate that the yearly production decreased by 54k bags since La Niña struck.

South Zone (Nariño, Hulia and others):

Accounts for 3.6m bags/year (31%), mostly from higher altitudes that receive good solar exposure. As such, this region is particularly associated with its quality, being the strongest arm in Colombia’s specialty industry. Harvest is due in the Apr-Jul period (dry season), forming the mid-crop (Mitaca).

[Want more of the good stuff? Be in the know by signing up for a premium subscription here!]

Weather Impact--El Niño & La Niña

Colombia’s position makes it particularly vulnerable to the El Niño and La Niña effects. These weather phenomena consist of variations in ocean and air temperatures that unbalance rainfall patterns, often affecting production.

Both last for a minimum of 3 months and maximum of 2 years, usually occurring in a 2 to 7-year timespan. However, in the last 2 years, La Niña has been particularly prolonged, although it’s now retreating.

The La Niña causes increased rains (wetness) and cloudiness (less solar exposure) in Colombia and it’s responsible for striking the crops throughout the key setting periods in 2021 and 2022, which decimated production. Furthermore, it played a major role in the increased wetness responsible for extending the 2008-12 Roya.

On the other hand, El Niño produces the opposite effect, and thus it causes reduced rains / rainfall deficit. It is particularly less impactful to most of the producing areas in Colombia, because of the country’s notorious good soil retention: a mild El Niño in 2015 barely affected production.

Climate Plus Geography = Unique Coffee Characteristics

The mountainous and tropical terrain, mild climate, and good soil retention create the perfect geography for producing coffees that are rich with flavor. For this reason, Colombian coffees are well known for being mild, balanced and very popular as the base in a blend.

The range of climates and elevations across the Coffee Axis enables the growing of several different varieties. The main ones are Caturra, Maragogipe, Tabi, Typica, Bourbon, Castillo, and Colombia. Altogether, Colombia offers subtly different flavor profiles, depending on where its coffee comes from.

The high quality and versatility of the Colombian coffee, combined with their large production make it an essential quality for single origin and Arabica blends around the world. As such the price of Colombian coffee is usually used as a benchmark for other washed coffees.

A high-quality Guatemalan coffee for example, is often thought to hold a slight premium over Colombian coffees. While a high-quality Honduran or Peruvian coffee, might be thought to hold a slight discount to Colombian coffees. Roasters and traders often think of pricing in terms of relationships like these and so when the price of Colombian coffee changes, it will impact the price of other coffees as well.

Application to the Market

Understanding the geography and production regions of Colombia is essential for the consumers and traders of physical coffees, but also for the traders and analysts of the futures markets.

Colombia’s status as the leader of washed coffees is a blessing to the market but also a curse, as its microclimate leaves it vulnerable to adverse weather events, something we have seen with increasing frequency over the past few years.

Washed Arabicas are the only tenderable quality for the “C” market Coffee contract, and Colombia is the leading producer of these. To anticipate the risk of weather events of supply shocks, traders and consumers will need to know which regions to watch and how production will be affected.

These potential shocks, as well as long term trend shifts can have ripple effects throughout the coffee markets: both physical and futures. If you are a trader that cares about these markets, then you too, will need to keep a close eye on Colombian Coffee.

[To stay up to date on the highest quality global coffee market analysis, and the latest market news and weather forecasts, sign up for a free trial to our premium reports.]

Comments