Coffee Rallies 27c in 3 days, Bubble or Boom?

- Ryan Delany

- Aug 25, 2022

- 2 min read

Just a few weeks ago #coffee was below $20 and the downtrend from $250 had decimated many bulls. However, since that peak bearishness, we have seen a trend channel steadily recover #coffeefutures prices culminating in a 27c rally in just 3 days! This is not behaving like a bear market...or is it?

The chart below is a graph of the anatomy of a bubble and I present it here as a cautionary tale.

There are two sides to every story and I certainly will not deny that the market can go to $3. That's always been the target for many people, and many folks were surprised when we didn't get to that level in the first half of 2022.

I have lived through a couple of major bull markets in coffee (2010 and 2014) and been mentored by those who have lived through others, and in this brief note, I want to highlight some of the risks:

1) at the top everyone is bullish. It goes further than you think and you don't want to be the first one to short.

2) there is always a secondary high. In 2014 this actually rallied above the initial high. The secondary high often occurs after a bearish period in May - Aug (Brazil Harvest). In terms of the anatomy of a bubble, this is the "return to normal" where all of the disappointed bulls say that they were right after all.

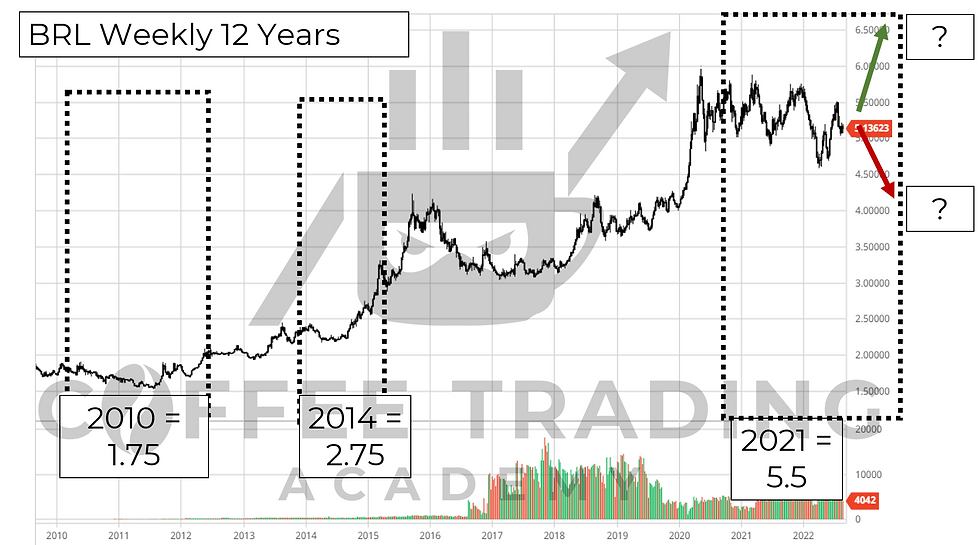

3) don't discount the macro. In 2010, the BRL was very strong and we rallied to $3, in 2014 the BRL was weak and we barely made it past $2.30. In 2022 we the BRL is twice as weak as it was in 2014 and the USD is strong.

4) the market is forward looking. Any adjustment to the current crop is important, but not as much as adjustments to the 23/24 crop. There are signs that this crop could be compromised, if this crop has problems over the next couple of months, then the market will have good reason to rally to $3 and beyond.

5) stay humble, have your view but consider new information. There are a lot of different factors that will influence price and the market doesn't care about your ego or your position. Even with perfect analysis, probabilities will dictate that you will get your position wrong sometimes even when your analysis is "right".

Good luck with your trading!

Comments